I'll do what I can to offer some excerpts, but the whole thing merits your perusal.

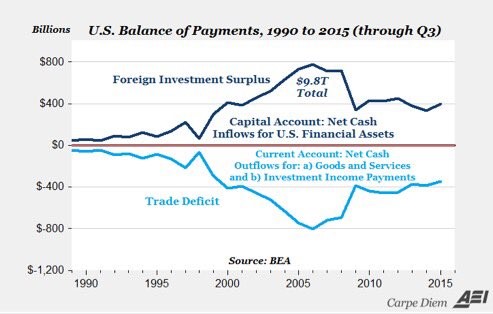

This gives you a taste. Lincicome goes on to discuss how China would go to the WTO to obtain retaliatory tariffs, how China has big-time currency woes, and how American families would be affected.the entire premise of Trump’s plan to retaliate against China is erroneous. Trump cites the U.S.-China trade deficit as proof that the dominant Chinese, via pernicious currency manipulation, are taking weak America’s manufacturing jobs, thereby justifying his tariff plans.However, as I explained in The Federalist last fall, the U.S. manufacturing sector has been (until the last month or so) setting production (and export!) records, and almost 90 percent of the decline in U.S. manufacturing jobs between 2000 and 2010 was caused by productivity gains (robots and computers), rather than import competition.In fact, a recent Ball State study found that, “Had we kept 2000-levels of productivity and applied them to 2010-levels of production, we would have required 20.9 million manufacturing workers. Instead, we employed only 12.1 million.” So unless Trump wants to destroy all the robots, those jobs just aren’t coming back, tariff or not.Furthermore, the idea that the U.S.-China trade balance proves that we’re “losing” at trade is the height of economic ignorance. For one thing, there’s actually a strong correlation between U.S. economic growth and an expanding U.S. trade deficit. As Cato’s Dan Griswold wrote:An examination of the past 30 years of U.S. economic performance offers no evidence that a rising level of imports or growing trade deficits have negatively affected the U.S. economy. In fact, since 1980, the U.S. economy has grown more than three times faster during periods when the trade deficit was expanding as a share of GDP compared to periods when it was contracting. Stock market appreciation, manufacturing output, and job growth were all significantly more robust during periods of expanding imports and trade deficits.Moreover, basic economics teaches us that trade balances reflect national savings, consumption and investment, not trade policy. Thus, every dollar traveling overseas to buy imports (in excess of our exports) eventually comes back to the United States in the form of investment, and our “trade deficit” is matched by a “capital account surplus.” In other words, we buy goods and services from foreigners, and they buy an equal amount of our exports plus our financial assets (aka foreign investment in the United States).In this light, the U.S. trade deficit reflects little more than America’s longstanding comparative advantage as a global investment destination. Not so scary, huh?Our Trade Balance With China Doesn’t Matter

If fixating on the overall U.S. trade balance weren’t dumb enough, Trump goes one step further and obsesses over an even more meaningless stat: the U.S.-China trade balance. As I’ve examined repeatedly, the proliferation of global supply chains and multinational investment has rendered bilateral trade balances an empty trade policy metric.Indeed, old-school trade stats like these have become so obsolete that the World Trade Organization has launched a global initiative to determine how better to account for actual trade flows. The most common example of the indisputable obsolescence of the U.S.-China trade deficit is the iPhone: each device imported into the United States from China accounts for about $300 towards the bilateral trade deficit, yet the Chinese get only about six bucks worth of value from the item’s assembly and shipment. Meanwhile, the U.S.-based Apple and its affiliates get hundreds of dollars from an iPhone’s final U.S. sale (for things like design, marketing, and even some manufacturing).Indeed, the only “analysis” tying the U.S.-China trade balance to American jobs is a bogus one from a left-wing, union-run, and union-funded outfit that has been so repeatedly debunked by legitimate experts that it’s only cited by protectionist unions and political hacks like Chuck Schumer. But, hey, if you don’t want to take my word for it, two American Enterprise Institute scholars further dismantled Trump’s trade deficit blather in their recent recap of Thursday’s debate.

No comments:

Post a Comment